I wrote this for Seeking Alpha and they declined to publish it. So, just so that it does see the light of day as a forecast, here it is:

Ramaco Resources - The Rare Earths Are Worse Than I Thought

Much worse than I thought

Ramaco Resources (METC) has now released the Preliminary Economic Assessment Report on its rare earth plans. This has been conducted by Fluor.

I've written a number of times about these rare earth plans here at Seeking Alpha. Here, here, here, here, most recent to oldest. All along I've said I'm looking only at the rare earth proposals, not the metallurgical coal - on the fairly useful basis that I know little about metallurgical coal and quite a lot about rare earths.

But, now they've come out with their estimates about those rare earths. The full presentation is on July 8th but there's enough information here for us to come to judgement already. This is worse than I thought it would be. It's not going to work.

Just to clarify

All along I've been saying that yes, sure, there will be rare earths - and germanium, gallium - in the clays and so on surrounding their coal. It's obviously possible to extract those - you can extract anything from anything at a price. That's not enough for a profitable mining operation, obviously. The question is what is the cost of extracting how much? With the interesting next question of how much of that can you sell?

The answer, here for METC, is that they'll not be able to sell what they claim to be able to extract at the price they claim. Well, that will be my claim about it anyway.

To me, at least, there's no point in going through a long analysis of what they're claiming, we can cut straight to the quick, here:

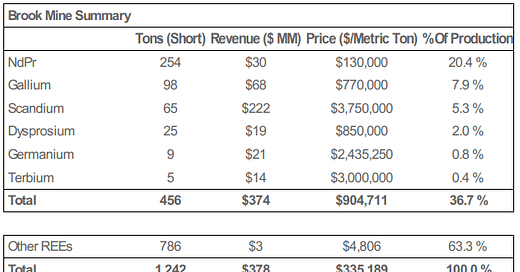

Ramaco RE revenues (Ramaco)

Those prices are looking pretty rich as against the market. Nd's down at around $55k a tonne these days. Gallium - the low level material that might be produced here - is about half the price they're using. And coming to market with perhaps 20% of global consumption isn't going to support that Ga price. The Dy and Tb prices look very rich - possibly some sort of forecast of what might be true in the future but simply not reflective of today's prices.

Now, some - including the editors here - will or - in the case of the editors here have - might query the pricing I'm indicating. It is true that some, and I'll not name them for good reason, suggest Ga runs well over $1k a kg these days. That's, to be very polite about it, a seller's price not a market one. Bulk gallium is going at more like $300 a kg on the Chinese wholesale markets. If we want to look at USGS numbers then highly pure (ie, 99.9999 and above) might go for double the 99.99%. But a mine operation like this isn't going to be putting out highly pure material and so isn't going to be getting that price.

But we only need the one. Scandium revenue is more than 50% of total revenue.

Ramaco margin (Ramaco)

If we take that $222 million scandium revenue off the top then the project loses $79 million a year. That's even before we might try to adjust other prices to something more reasonable and reflective of current market.

So, the correct way to do a quick analysis is to look at this as a scandium mine.

A scandium mine

As a scandium mine this isn't going to work. I've no problem with the claim that the scandium is there. Obviously, I'd want to see a little more proof before affirming it, but the idea doesn't surprise. Equally, the ability to extract it, sure, that's possible.

The problem is with being able to sell that volume - 65 tonnes a year - at that price - which is $3,750 a kg.

That price might start some bells ringing. It's the same price Niocorp has been using to tout their niobium, scandium, titanium mine. Which I've written about - again in order newest first, here, here, here and here. That's also not the market price. It's not anything close to the market price as I've been saying for those many years now (at least since 2017).

For those unaware, I used to wholesale some 50% of the world's usage of scandium. I'm not in the game any more but still know rather a lot about it. So much so that I was asked to do a little consulting a couple of months back, something that required updating some numbers.

A large Chinese plant quoted me $540 a kg (note, five hundred and forty) for pretty much whatever volume of scandium oxide I wanted. The world's largest user is generally accepted to be Bloom Energy and their 2024 consumption was under 5 tonnes (we looked up the customs records of their imports). In fact, as Sc2O3 it was under two tonnes, another 2.5 tonnes of scandia stablised zirconia (which is, obviously, less than 100% Sc2O3).

Now, the USGS indicates consumption as possibly 40 tonnes. I disagree with that. And, well, you know, bully for me. Who are we going to believe, the guys employed by Uncle Sam or some self-declared expert? So my estimate of usage is going to have to be presented as my estimate which disagrees with the official estimates. And there we are.

A contact gained me this information along the way. It's from the bills of lading databases. Which is an imperfect but pretty good source. It gives a sense of scale at least:

Bloom energy scandium (Bills of lading database)

As far as I know (and the only people I can think of who might be using more are the Russian military, from Rusal, which is not really relevant to us here) Bloom are the largest user.

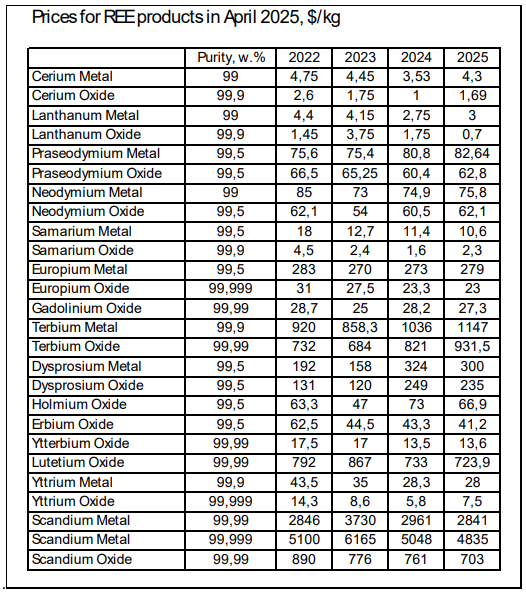

Of course, of course, I could be wrong. But one more thing. Hallgarten has just released a report on rare earths. They make many of the same points - about separation and so on - that I've made here over the years. Which is nice. But here's their price chart:

Rare earth prices (Hallgarten)

Note that scandium oxide is at $700. A little above what one Chinese factory recently quoted me. And one fifth and less of the price that Ramaco is assuming in its cash flow projection. Which is, I think, the point to really grasp.

Sumitomo has a nickel laterite plant in the Philippines that can extract scandium from the process flow - up to 12 tonnes a year capacity. This is apparently now not producing due to prices being below production costs.

Some estimate the global scandium market at 15 to 20 tonnes a year at present and USGS as at much as 40 tonnes. I think that a gross over-estimate given how little Bloom seems to be using. Yes, I do know about Airbus and their lovely alloys - I supplied their research and development team for many years.

The Ramaco Proposal

Given the dominance of scandium in the revenue estimates what METC is really proposing is a scandium mine. I don't doubt that there's scandium there, I don't doubt it can be extracted. What I am adamant will not happen is that they are able to sell 65 tonnes a year at $3,750 a kg. A much closer estimate of their scandium revenue would be nothing, zero. At which point there is no project here, is there?

Why I'm wrong

Sure, someone who knows the business can still be wrong. Maybe there's some grand new use of scandium which will soak up the new production. I really do tend to think it's unlikely though.

I'm not wrong about the coal because I've not made any comment about it.

Now, it is important to note that some of the estimates of usage are different from mine. I think the general talk has managed to convince itself. So, I could be wrong on that.

My opinion

Ramaco is telling us they can sell many times current world consumption - say, three to five times it - at many times current world prices - say, three to five times it. This is not how the world works.

So, as above, say I'm wrong on the size of the market. The USGS estimate, say: "In 2024, the global consumption of scandium oxide was estimated to be about 30 to 40 tons per year with a global capacity estimate of 80 tons per year. According to industry estimates, global production totaled 40 tons." Say that's right, just to put a higher limit on our size of the market.

But now think a moment. The current price is that $700 a kg (no, the metal price is not important, that's a tiny fraction of usage) and even by the USGS numbers there's 50% unused production capacity at that price. The chance of someone coming into the market with 150% of current consumption and being able to sell at 5x current prices is what? Well, quite.

The rest of the business? The coal? Sure, not something I know about. But their rare earths mine is really, given revenue predictions, a scandium mine. My opinion is that there's absolutely no chance at all of their being able to meet those sales targets - not in volume, not in price and most definitely and absolutely not in volume and assumed price.

As with Niocorp all these times - and more detailed explanations are in those pieces - it's just not going to happen.

A reasonable guess from me is that this rare earths proposal has a zero value. In fact, with my cynical hat on I'd suggest a negative one for the company as a whole. For I don't - now - trust management that would seriously put forward a scheme with such a hole in it.

In my consulting days as a spreadsheet guru, I had to create financial models like this one quite often. A spreadsheet model has two important bits. One is the parameters table, containing prices, volumes and suchlike. The other bit is the bottom right-hand corner. By playing around with the parameters you can always get the bottom right-hand corner to say whatever you want.

This is exactly my analysis as well, but much better stated. Ramaco's REE claims have been a fraud since Day 1 but Atkins is a Grand Master of sucking in politicians and the media. I characterize my following of the Brook Mine scheme for these many years as watching a bank robbery in progress. Great discussion and insight, Tim